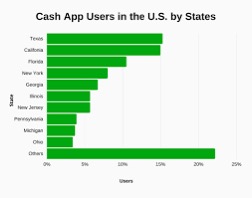

Cash App usage varies significantly across different demographics and geographical regions. The frequency, amount of transactions, and functionality utilized can be influenced by various factors such as age, income level, and location. For instance, a younger demographic might use Cash App more frequently for smaller, casual transactions, such as splitting the bill after a meal with friends.

On the contrary, older users might use the app less frequently, but for larger transactions, such as paying for services or transferring money to family members. Geographical location also plays a role in Cash App usage. In urban areas, where digital transactions are more common and widely accepted, the use of Cash App is likely higher compared to rural areas, where cash transactions may still be more prevalent.

Furthermore, the functionality used within Cash App can also vary. While some users may only use the basic money transferring feature, others might utilize the more advanced features such as investing in stocks or Bitcoin. These variations in usage are important considerations for the developers of Cash App as they continue to improve and expand the app to cater to the diverse needs of its users.

Cash App for Personal Transactions vs Business Transactions

Cash App, a popular mobile payment service, caters to both personal and business transactions. However, the use for each differs significantly. For personal transactions, Cash App makes it simple to send or receive money from friends or family, split costs for a meal, or pay your share of rent. It’s a convenient tool for managing everyday expenses without the need for cash on hand. However, these transactions are typically low in volume and frequency, and there usually isn’t a need for detailed transaction records or tax documentation.

On the other hand, business transactions via Cash App are more complex. Businesses often need to process high volumes of transactions, which may require more robust customer service support and advanced features, such as invoicing or sales reports. These features are not available in the basic Cash App and would require a business account, which is subject to fees. Additionally, businesses must keep detailed records of all transactions for tax purposes and financial reporting. While Cash App does provide some record-keeping capabilities, it may not be enough for some businesses’ needs.

Therefore, while Cash App is a versatile tool suitable for both personal and business transactions, it’s essential to understand the distinct requirements and capabilities for each use. Personal users may appreciate the app’s simplicity and convenience for quick, casual transactions. In contrast, businesses may find value in the expanded functionality of a business account, despite the potential for additional costs. However, they should also consider the limitations in customer service and record-keeping capabilities when deciding whether Cash App meets their business needs.

Differentiating Cash App Applications: Personal vs Business

Cash App applications can be categorized into two primary types: personal and business. Understanding the variance between these two is crucial for the effective management of finances. Personal Cash App is primarily designed for casual transactions between family and friends, such as splitting dinner costs or sharing travel expenses. It is more suited for individual, non-business related transactions and hence, its use is often limited to small-scale, informal payments.

On the other hand, a business Cash App account is more robust and caters to the needs of businesses and entrepreneurs. It is designed for receiving payments for goods and services provided by a business entity. This type of account charges a 2.75% fee for each transaction made, a cost that is often transferred to the customer. It also provides the business owner with a more comprehensive transaction history, which can be beneficial for record keeping and financial tracking.

Despite their differences, both personal and business Cash App accounts offer certain similar features such as the ability to send and receive money instantly. However, the choice between the two should be made based on the individual’s or business’s specific needs. For instance, if you frequently transact with a large number of individuals or businesses, it may be more convenient to use a business account. Conversely, if your transactions are primarily with friends and family, a personal account may be more suitable.

It is also important to note that misusing a personal account for business transactions can result in penalties or account suspension. Similarly, using a business account for personal transactions can lead to unnecessary charges. Thus, it’s essential to differentiate and utilize the Cash App applications appropriately to ensure efficient financial management.

Using Cash App: Personal vs Business Accounts

Cash App is a mobile application that facilitates smooth and swift money transactions. This platform allows users to have either Personal or Business accounts, each designed to cater to different needs. Personal accounts on Cash App are typically for individuals who want to send and receive money from friends, family, or acquaint goodances. These transactions might include splitting a dinner bill, sharing gas money, or contributing to a group gift. Personal accounts are also useful for small, informal businesses or sole traders who have occasional sales.

On the other hand, a business account on Cash App is designed for more formal businesses and merchants intending to accept payments for goods or services they provide. With a business account, you can receive payments from customers, and the payments are tagged as business transactions. Notably, the fees structure for both accounts differ. Personal accounts enjoy free transactions, while business accounts are charged a 2.75% fee per transaction.

It’s essential to understand the distinction and choose the right account type for your needs. If you’re found using a personal account for business purposes, it may result in account suspension, as it violates Cash App’s terms of service. The platform encourages users to upgrade to a business account if they wish to receive payments for goods and services.

Although both account types offer many similar features, the primary difference lies in their intended use and the fees charged for business transactions. In conclusion, Cash App provides a convenient and efficient way of managing money, whether for personal use or business transactions, ensuring users can choose an account type that best suits their needs.

Comparison of Cash App Utilization: Personal vs Business Needs

Cash App, a popular mobile payment service, has distinct features that cater to both personal and business needs, with each having unique benefits and usage scenarios. On one hand, personal usage of Cash App is often characterized by simplicity and quickness in transferring funds between friends, relatives, or acquaintances.

For example, splitting a dinner bill or sending a gift amount to a family member can be done with just a few taps, making it a convenient tool for informal, peer-to-peer transactions. On the other hand, the business use case of Cash App extends to a broader spectrum. It allows businesses to accept payments from customers, clients, and partners.

This feature is particularly advantageous for small businesses as it provides them with an easy, cost-effective way to handle transactions. Moreover, Cash App for business aids in keeping track of income as it provides an organized record of all transactions, which can be useful for financial management purposes.

However, the utilization of Cash App for personal and business purposes also differs in terms of fees and tax implications. Personal use of Cash App typically does not incur any fees unless a user opts for instant transfers. In contrast, businesses who use Cash App are required to pay a certain percentage of the transaction as a fee. Furthermore, the income generated through business transactions on Cash App is typically subject to taxation, and it is the responsibility of the business to report such earnings.

In conclusion, the utilization of Cash App has evolved to cater to both personal and business needs, each with its own advantages and considerations. Whether it is for personal or business use, Cash App provides a flexible, convenient, and efficient platform for managing transactions, albeit with different implications and requirements for each type of use.

Understanding Cash App Usage: Personal vs Business Contexts

Cash App, a mobile payment service, allows users to send and receive money with a few simple taps on their smartphones. However, it’s crucial to understand the differences in usage between personal and business contexts. In a personal context, Cash App is often used for casual transactions such as splitting a dinner bill with friends, paying rent, or sending gifts to loved ones.

These transactions are typically between known individuals, and the amounts involved are usually not substantial. On the other hand, the business usage of Cash App is more formal and involves larger sums of money. Businesses use Cash App to accept payments from clients or customers, pay suppliers, or even manage payroll. To differentiate these two types of usage, Cash App offers two types of accounts: personal and business. A business account, also known as a Cash App for Business account, charges a 2.75% fee per transaction, while personal accounts do not.

However, a business account provides additional features such as the ability to issue refunds, track sales, and accept payments via a website. Therefore, it’s essential for users to choose the appropriate account type based on their needs and usage. It’s also advisable to adhere to the company’s terms of service to avoid any potential issues or complications. Understanding the different contexts of Cash App usage not only helps users make the best use of the app’s features, but also ensures smooth and hassle-free transactions.

Conclusion

A conclusion serves as a crucial element in any form of writing or discourse. It is the final segment where all the points discussed throughout are summarized and the writer’s or speaker’s perspective is clearly stated. This provides the audience with a quick recap and a clear understanding of the subject matter. It can be viewed as the ‘climax’ of the narrative or argument, where everything converges towards a unified viewpoint.

A well-structured conclusion doesn’t introduce new ideas; rather, it reinforces the existing ones, providing a sense of closure and resolution. It is an opportunity for the author to have the final say on the issues presented, to synthesize them into a coherent whole, to demonstrate the implications of the ideas, or to propose solutions. In essence, the conclusion serves as the mirror image of the introduction: where the introduction draws the reader into the text by setting the scene and posing intriguing questions, the conclusion seeks to take the reader beyond the text, raising further questions or suggesting broader implications.

It should leave the reader with a lasting impression, emphasizing the relevance and importance of the topic. In academic writing, the conclusion can also present recommendations for future research. As such, a conclusion is not merely the end of a piece of writing. It is a thoughtful end, which gives the writing a sense of completeness and leaves a final impression on the reader. It is a powerful tool that can either make or break your piece of writing. Therefore, it should be crafted carefully to ensure it effectively sums up the arguments and presents a compelling final impression.